Quarterly Insights

Q2 2024 Preview: Key Areas of Focus

April 2, 2024

If you would like to see a video of Nick’s Market Commentary, click here: https://fpsfinancial.advisorlibrary.com/q2-2024-preview-key-a5yfah535c

This year commenced with a promising outlook, but uncertainties still loomed, largely driven by geopolitical tensions and lingering effects of supply chain disruptions. As the quarter progressed, economic indicators hinted at resilience, albeit with challenges. There were debates over a “soft” versus “hard” landing as the Fed attempted to stabilize the economy. Only three months later, those concerns have given way to a calmer environment centered around fading inflation and the Fed’s plans for reducing interest rates. This has resulted in a strong market rally with the S&P 500 index, Dow Jones Industrial Average, and Nasdaq gaining 10.2%, 5.6%, and 9.1% year-to-date, respectively.

The economic environment in Q1 surprised many investors as inflation continued to fade. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures index, rose 2.5% on a year-over-year basis for all prices, a significant improvement from its peak only a year and a half ago. While some areas of inflation such as shelter and energy costs remain problematic, inflation is steadily moving back to the Fed’s long-term 2% target.

Meanwhile, unemployment is still under 4% despite layoffs in the tech sector, interest rates have been more stable with the 10-year Treasury yield around 4.2%, and stock market returns have broadened beyond artificial intelligence stocks. Despite these positive trends, some investors are concerned about the upcoming presidential election and the next phase of Fed policy. These worries are only amplified by the fact that the market is hovering near all-time highs.

In uncertain market environments like this, it’s more important than ever for investors to maintain a long-term perspective. Below are three insights into recent and upcoming events and how they have historically affected investors.

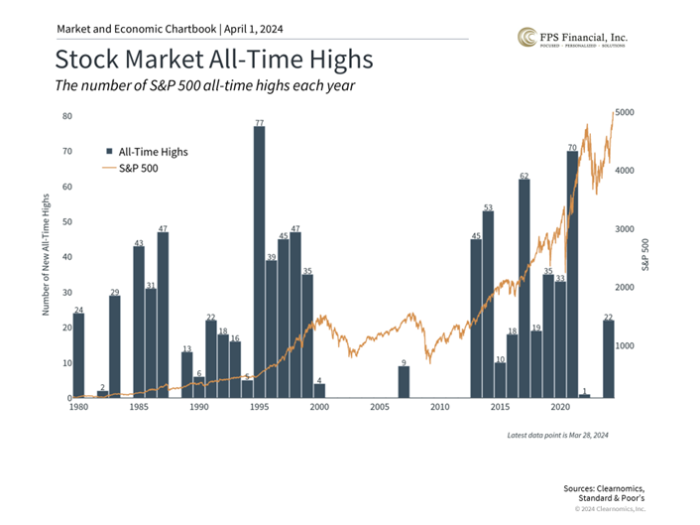

1. Steady economic growth has driven markets to new all-time highs

The S&P 500 has achieved 20 new all-time highs so far this year despite the brief market pullback during the first two weeks of the year. While this is positive for investors, it is easy to worry that continued market growth may not be sustainable. Do new all-time highs mean that the market is due for a pullback?

While price swings are an unavoidable part of investing, and the market does experience pullbacks from time to time, history shows that markets also tend to rise over long periods. As the chart above shows, 2021 experienced 70 days with the market closing at new all-time highs, adding to the hundreds that were achieved since 2013.

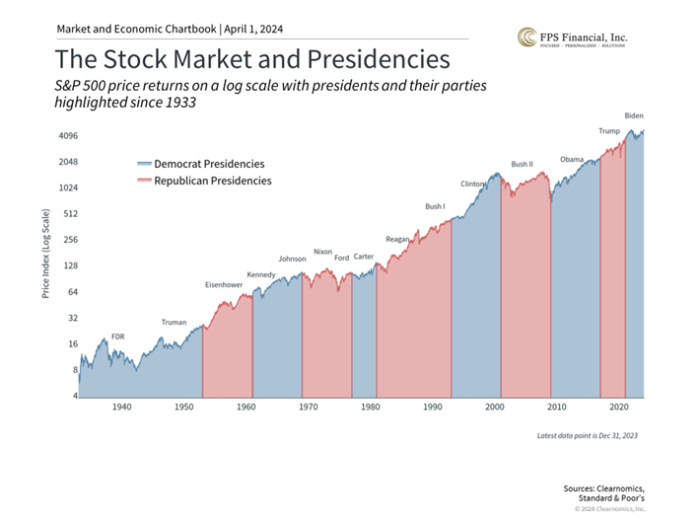

2. Markets have rallied through both Democratic and Republican presidencies

Coverage of the presidential election is heating up ahead of the November rematch between Presidents Biden and Trump. While elections are an important way for Americans to help shape the direction of the country as citizens, voters, and taxpayers, it’s important to vote at the ballot box and not with investment portfolios. This is because history shows that markets can perform well under both Democrats and Republicans. As the accompanying chart shows, the economy and stock market have grown over decades regardless of who was in the White House.

Of course, politics can impact taxes, trade, industrial activity, regulations, and more. However, not only do these policy changes tend to be incremental, but also the exact timing and effects are often overestimated. Thus, it’s important to focus less on day-to-day election poll results and more on the long-term economic and market trends.

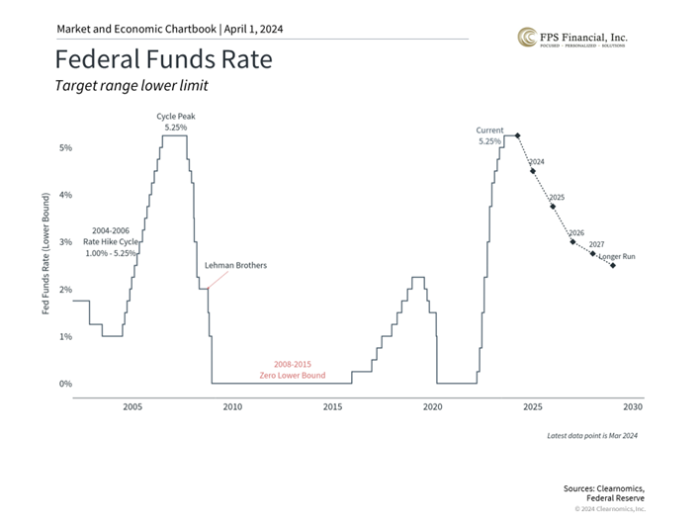

3. The Fed is expected to cut rates as inflation stabilizes

The Fed is expected to cut rates later this year although the timing remains uncertain. The accompanying chart shows the possible path of the federal funds rate based on the Fed’s latest projections, including three cuts this year. At its last meeting, the Fed cited strong job gains and low unemployment as indicators of solid economic activity but emphasized that “the Committee does not expect it will be appropriate to reduce [interest rates] until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” Regardless of the exact timing and path of Fed rate cuts, these projections represent a reversal of the emergency monetary policy actions that began in early 2022.

The bottom line? With markets near all-time highs, a presidential election approaching, and Fed rate cuts expected to begin later this year, it may be best for investors to stick to their existing financial plans while staying invested in the second quarter of the year. History shows that this is typically the best way to achieve long-term financial goals. We are always here to help!

Sincerely,

Mike Ovshak, CFP® Nick Ovshak, CRPC®,CFP®

President, Owner, Senior Financial Advisor Lead Financial Advisor / Manager

This letter is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purpose. Any examples used are generic, hypothetical and for illustration purposes only. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. All indices are unmanaged and investors cannot invest directly into an index.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets.

###

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.